APGA at the RACGP Owners Conference

AGPA participated at the RACGP Practice Owners Conference in Adelaide 20-21 May 2023.

A big thanks to AGPA Directors Dr Craig Richards (NSW) and Dr Richard Barker (QLD) for two days of hard work at the AGPA stand.

![]()

General Topics

AGPA participated at the RACGP Practice Owners Conference in Adelaide 20-21 May 2023.

A big thanks to AGPA Directors Dr Craig Richards (NSW) and Dr Richard Barker (QLD) for two days of hard work at the AGPA stand.

![]()

The AGPA will be present at the upcoming RACGP Practice Owners Conference 20 & 21 May 2023.

A number of Directors will be present so this will be a great opportunity to catch up and discuss the issues that are important to you as a Practice Owner and what the AGPA can do to help.

See you at Stand 53

MEDIA RELEASE

9 May 2023

INCREASED BULK BILLING INCENTIVE PAYMENTS ARE A WELCOME INITIATIVE FOR REGIONAL, RURAL & REMOTE AUSTRALIA

The increased bulk billing incentive will be a major benefit for primary healthcare in regional, rural & remote Australia and will help retain and attract GPs into those areas. The benefits will be much lower for metro Australians.

A short consultation in remote Australia is now funded at $79.40, but a metro Australian is only worth $60.40. With metro fee rates already at over $90 the opportunity cost for a doctor to bulk bill in metro Australia is approximately $30.

The Australian GP Alliance is pleased that the Commonwealth Government is attempting to increase access to primary healthcare for vulnerable Australians and restructure support for chronic disease management. It is vital that any new scheme does not diminish access of care for the 50% of Australians living with a chronic disease.

The Commonwealth Government must work with States & Territories to stop taxing Commonwealth Medicare patient payments and all medical professional fees. Until this is done the good intent from this budget will be unsuccessful.

On 2 May the Hon Mark Butler MP, Minister for Health gave an address at the Press Club in Canberra.

Some highlights from that address are are below:

Minister for Health and Aged Care – Speech – National Press Club – 2 May 2023

Media event date: 2 May 2023

Date published: 2 May 2023

Media type:Speech Audience: General public

Selected Comments – Full speech is available here

I’d like to begin by acknowledging the traditional owners of the lands on which we stand, the Ngunnawal and Ngambri people.

I offer my respect to Elders past and present and extend that respect to any First Nations people joining us today.

………

Now it might seem strange to start a speech on the future of Medicare by talking about the past.

But to understand the future of Medicare, you have to go back to its beginning.

So cast your mind back – those of you old enough to remember – to 1984.

Bob Hawke is the Prime Minister and Medicare is in its first year.

The Ford Falcon is Australia’s bestselling car.

“Ghostbusters” is the pinnacle of movie special effects.

Fax machines are in every office.

And in the suburbs of Adelaide a teenager is praying that his mum will buy him a walkman for his 14th birthday.

Medicare was created to solve the health problems of 1984.

In those days … we were younger, on average, and tended not to live as long.

We smoked a lot: 40 per cent of men and 30 per cent of women were regular smokers.

Our health issues were more episodic and acute.

Back then, Medicare was a symbol of modernity.

But it didn’t have an easy birth.

2 February 2023 the AGPA wrote to the NSW Premier, Health Minister and Treasurer and their Shadow counterparts.

We expressed our concerns regarding the potential impact of taxing medical professional payments under the payroll tax and the impact that this would have on bulk billing as Practices would need to suspend bulk billing to develop contingency funds, pointed out that because of the way GP is structured it is a tax exceeding 10% on Practice revenue and requested that the State consider amending the payroll tax act to exempt medical professional fees.

Today we have received an […]

Commencing 1 January 2023 the MBA has introduced a new CPD – system. GPs need to:

The format will be a discussion session with AGPA Director Dr Bernard Shiu explaining the new CPD system, the new changes and requirements.

We will discuss:

All attendees using the RACGP CPD home will get 1 Hour of CPD – Just provide your RACGP number when you register.

The intention is that you will be able to ask the questions, contribute your own experience and by the end of the session you will know how to make the CPD system work for you and your Practice.

Remember: cameras on and questions ready!

or

https://www.trybooking.com/CGWJB

Places will be limited, preference will be given to AGPA members.

For further information contact the AGPA Secretariat

AGPA continues to lobby with news media and at the political level to bring issues of importance to General Practices into the spotlight.

Two recent examples from Dr Mukesh Haikerwal, foundation member and Deputy Chair, on The Project 29 January and in a special ABC report (Youtube) from Bridget Rollason

The imposition of payroll tax on medical professional fees is in reality a tax on Practice revenues.

In 2020 a case in the Victorian Court of Appeal confirmed the right for the Victorian State Revenue Office to charge payroll tax on payments made to medical professionals. The payroll tax appears to be payable regardless of the status of the medical professional being an independent contractor or an employee.

Since that precedent both NSW and Queensland have also been imposing payroll tax on General Practices apparently where they consider that the behavior of the Practice is more akin to an employer […]

The impact of under funding of Medicare, and GP shortages are starting to seriously impact on the cost of patient access to GP services.

GP bulk billing rates have declined sharply in all states over the last five quarters. Falling from just under 90% in the 2021 September quarter to 83.5% in the 2022 September quarter, rates have declined over 6% nationally but in in the ACT and the NT this decline exceeds 10%.

The ACT has the lowest rate of bulk billing at just over 61%.

6:30 pm Queensland, 7:00 pm SA, 4:30 pm WA

AGPA Webinar

Presented by: AGPA

Speakers:

Dr Brenda Murrison, Dr Fiona Raciti, Dr Jared Dart

As part of our Practice Sustainability webinar series AGPA has asked members to discuss some of the options they have followed or considered for their Practices.

Declining Government support for primary healthcare via Medicare has impacted on Practice income and in some cases Practice viability.

A common response has been to move Practice billing to mixed or private billing, but some Practices have also taken the opportunity to develop income streams from non-Medicare sources. These options include other government programs, corporate programs and non-Medicare individual medical demand.

It has involved the services of both GPs and allied health professionals.

The focus of the evening will be the presentation of options that some Practices have pursued and the approach required to achieve beneficial outcomes for Practice income.

The intention is that you will be able to ask the panel questions and contribute your own experience.

https://www.trybooking.com/CEPCN

Places will be limited, preference will be given to AGPA members.

For further information contact the AGPA Secretariat

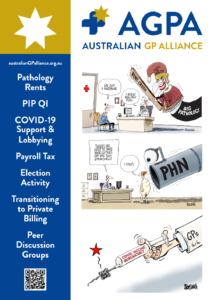

The Australian General Practice Alliance was formed in 2016 to represent the interests of GP practice owners. While the initial trigger for the formation of the AGPA was the attacks on General Practice by the Australian Government and big business pathology, our aim is to address the issues that face principal led General Practices.

Read more »

You can download a PDF application for Full Membership here.

You can Join and Pay Online here »