Webinar

Tuesday 29 August 2023, 7:30pm AEST

7:30 pm Queensland, 7:00 pm SA, 5:30 pm WA

AGPA Webinar

Payroll Tax – Another View

Speakers

Paul Copeland, Director, William Buck

Ben Ryan, Senior Associate, Avant Law

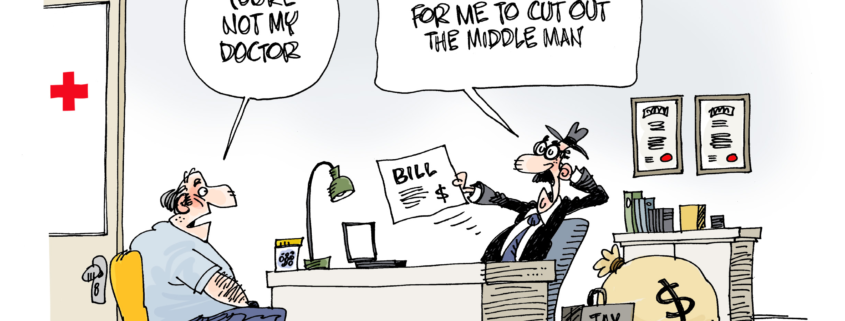

State Payroll Tax is threatening to become a major threat to the viability of General Practices in many Australian States.

Victoria, NSW, Queensland and South Australia are all applying precedents which allow them to charge payroll tax on medical professional fees paid to independent GPs under conventional General Practice structures.

Queensland and South Australia have both announced a moratoriums on the application of payroll tax rulings but the outcome at the end of the moratoriums will apparently require PRT to be paid.

Practices are faced with either charging patient levies to cover the tax (with issues for bulk billing), or restructuring so that the tax provisions do not apply. The risks with restructuring are significant with potential changes to financial management practice and to the relationships within the Practice.

The speakers will discuss approaches which reduce PRT exposure risk while maintaining key functionality.

Book at

https://www.trybooking.com/CKRZA

Places will be limited, preference will be given to AGPA members.

For further information contact the AGPA Secretariat

Speaker Profiles are here